How to Make a Mobile Wallet App All-in-One Development Guide?

Quick Summary: Learn to make a mobile wallet app in this comprehensive guide. Covering all aspects of development, it includes designing an intuitive UI, integrating secure payment gateways, ensuring data encryption, and implementing advanced features like NFC and QR code scanning. Create a seamless and secure mobile wallet experience for users.

Introduction

Over the years, mobile wallet apps have become a one-stop solution for all financial needs. These apps have brought finances to your fingertips. Hence having a secure and convenient mobile wallet app in this generation is the need of the time.

Whether you are an entrepreneur or an established business, it’s essential to rap into the world of financial technology. Therefore this guide will give you a deep understanding of making a mark.

With the expanding popularity of these mobile apps in the market, your business will need a wallet app that can change how people manage their finances.

The possibilities for Top Mobile App Development Services are endless, from conducting transactions seamlessly to paying bills effortlessly. But where will you begin from? No worries, we’ve got you covered!

This guide will take you through the complete process of developing a wallet app from scratch and getting the best fintech app developers. Hence will pave the way through all the aspects crucial in mobile wallet app development. Let’s dive in!

With the expanding popularity of these mobile apps in the market, your business will need a wallet app that can change how people manage their finances.

What Is A Mobile Wallet App?

Mobile wallet is literally a mobile version of your bank account in terms of the operations and the options it gives you to use the money with the help of your handheld devices. It is also wallet which helps in keeping their details about payments. Hence a safe and secure mobile wallet app is in high demand.

A user can perform various tasks such as making payments, online shopping, paying bills, one-to-one transfers, etc. These apps employ near-field communication and QR codes to facilitate contactless payments even at stores.

The fact that this application has a certain level of convenience is probably its strongest advantage. The user of this app would not have to carry a physical wallet for payment. For this reason you don’t need to carry an extra pack.

The digital wallet app development has provided applications with a higher level of security measures to ensure this accounts from fraud· One of the way to achieve this is through encryption methods and tokenization that makes it impossible for intruders to hackers to have access to users’ payment details.

In addition to robust security, mobile wallet apps integrate advanced authentication methods like fingerprint or facial recognition, offering an extra layer of protection for users’ transactions.

Moreover, these apps go beyond mere payment solutions by providing additional features. Transactional history, expenditure analysis, integration of reward programs, and personalized offers are a few examples.

These extra features are for the betterment of the users and are very in instrumentation for financial management.

Mobile wallet apps have transformed the payment landscape, offering unparalleled convenience, security, and supplementary features. As a result, they have become an indispensable tool in the digital age for efficiently managing finances and conducting transactions securely.

Delving into Mobile Wallet App Market

Recently, we’ve seen a phenomenal growth and transformation in the mobile money wallet apps industry. The mobile apps provide people with a digital platform through which they can securely keep, manage, and perform transactions via smartphones. The number of phone users worldwide continues to grow while the usage of cash has fast become unpopular hence the pronounced demand for mobile wallet apps.

This is one of the major driving forces behind the spread of this almost universal phenomenon· Individuals can make payments, transfer money, and do a lot of other financial transactions using a mobile wallet app on their smart phones· The convenience of payments and their efficiency are maximized because the user doesn’t need actual cash or credit cards.

The other worth mentioning advantages of mobile wallet apps· The use of the latest encryption technologies, biometric authentication and tokenization methods are the keys for enhancing security and trust among the end users.

The market has become incredibly competitive, drawing in different players, tech giants, financial institutions among others, fighting for the prize of this money-spinning market.

The following data dispels any worries regarding the value of developing a digital wallet app in 2022:

- The number of people using mobile payments is expected to increase to 1·31 billion by 2023· By 2024, the market for mobile payments is anticipated to grow to $3 trillion·

- The market for mobile payments worldwide was valued at $1449.56 billion in 2020, and it is anticipated to increase at a CAGR of 24.5% between 2021 and 2026, reaching a value of $5399.6 billion.

- Digital wallet app usage is anticipated to increase to 4.8 billion by 2025, making up 50% of all eCommerce payments.

What Is The Working Procedure Of The Mobile Wallet App?

A mobile wallet application is an electronic payment method on smartphones that is safe to store, handle and use, and as a result, it can be used to pay for goods and services. The more we use mobile devices and more and more people are switching to cashless transactions, mobile wallet apps are an essential feature of the modern global payment system. Our acquaintance with the regular mode of this app can start from here.

Registration:

The process begins by downloading the mobile wallet app on the devices that are supported by the regular app store. At a later stage, the installation requires users to sign up with their names and basic personal details, like email and phone numbers. Through the apps some of the available identity verification methods apply which are done by documents or biometric authentication.

Some of the common methods for digital identity verification include Biometric verification, ID document verification, or the more basic one-time passcode and phone verification. Each method secures a higher accuracy compared to manual identification.

Linking Accounts:

Users can then effortlessly connect many bank accounts, credit or debit cards and even other payment instruments to the wallet application on their mobile phones. This action frees users from the need of possessing huge schedules of cash in the bank or even carrying the burden of physical cash by enabling an interrupted transfer of funds between their bank accounts and their mobile wallets. Choose an appropriate fintech smartphone app building business in the procession.

Loading Funds:

Making it easy for users to score the necessary funds in order to use their best mobile wallet app, they may simply transfer their money from linked bank account or receive payments from others. It can be made through the many ways including bank transfers, using cards or QR code scanners.

Transaction Processing:

iPhone apps sincerely put in place different security features to guard the consumers’ money. Such as biometric identification, two-factor legitimacy, and cryptographic data communication and data storage for the financial and personal details. The application automatically deducts the transaction amount from the sender’s wallet and translates the amount to the recipient’s wallet.

Security Measures:

The features of mobile wallet applications to secure consumer finances include multiple security measures. These include protection against threats such as personal and financial data security, two-factor, and biometric verification. Moreover many apps offer features such as transaction history, instant notifications, and the ability to remotely turn off the wallet in case of theft or loss.

Additional Features:

Creating a digital wallet app often extends their functionality beyond basic payments. They may include features such as bill payments, ticket booking, money transfers to bank accounts, and loyalty programs. These additional services enhance the app’s convenience and versatility, making it a comprehensive financial tool.

Hence the functioning of a mobile wallet app involves registration, linking accounts, loading funds, conducting secure transactions, and offering various additional features. With their user-friendly interface, quick processing, and robust security, mobile wallet apps have significantly transformed how we manage money in the digital era.

What Must-Have Features Of Mobile Wallet App?

Smooth Onboarding Process:

As a mobile wallet app development company, you must adhere to several compliance requirements, making it essential to create a hassle-free onboarding process to ensure users don’t abandon the app due to difficulties accessing their identity proofs or financial details. To achieve this, the following is a typical Ewallet onboarding process:

- The user installs the app and launches it for the first time.

- The user enters personal information within the app, such as Full Name, Email ID, Mobile Number, Display Picture, etc.

- The system sends an OTP to the user’s email or cell phone for authentication.

- A password is set up by the user for additional security.

- Before users can add money to their wallet or receive payments, they must upload a scanned copy of their national ID for admin review.

- Users can add money to their Ewallet and make payments after successful ID verification.

QR-Code Payments:

To facilitate seamless payments, your Ewallet should enable users to scan QR codes for transactions. Hence offering contactless payment choices will be a wise decision in light of the value of social distance and personal hygiene.

Adding Money via Bank or Cards:

Users can either receive money from others or add funds to their wallets. Hence users should be able to store how they added money to their wallets on your Ewallet MVP app to make future transactions more convenient.

Faster Wallet Payments:

A key tenet behind the E-Wallets is the unprecedented speed at which the money can be transferred. Consequently, remittance facilities enable money to reach its destination within an appropriate period without delays, as users require such transactions to occur at a fairly right pace and speed.

Payment History:

Make a mobile wallet app which enables one to view the payment history which the recent ensures transparency and allows to keep a tab of one’s spending. Over the years, spending history can extend a big helping hand to the ones who may misplace their entries already.

Third-Party Bill Payments:

Even an Ewallet may have nothing more than just a payment function. In order to circumvent app fatigue and stand distinct from others, the ability to use the app for paying third-party service and as well as bills will yield a good point of addition to your app’s features.

Payment Requests:

Even though this feature is no “revolutionary,” it is crucial that B2B payments can be requested when the same is made to other users. This means that, just like PayPal which allows you to add or create bills and payment requests for future reference or payments, this feature will add on to the platform’s functionality even more.

Push Notifications:

Push notifications, or the mobile forms of them, have become ubiquitous; however, success relies on finding this balance. Therefore, keeping users from blocking your notifications by always bombarding them with false warnings is one of the site’s strategies. Minimize the number of your notifications to control your distraction epidemic.

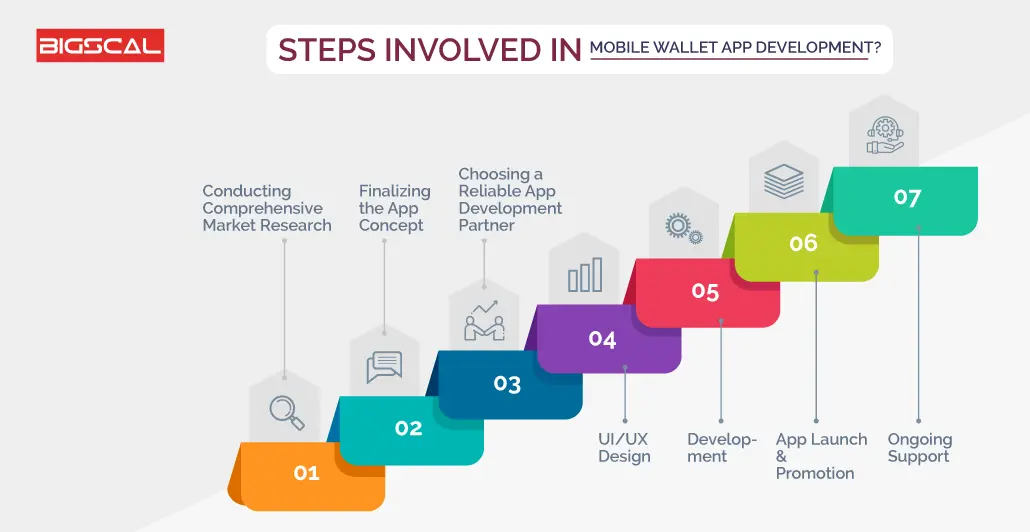

What Are The Steps Involved In Mobile Wallet App Development?

Conducting Comprehensive Market Research:

When starting a reconstruction process of mobile wallet app development, it is paramount to conduct a market research. This one is for identifying the latest trends, knowing who the customers are, and scanning the environment for possible competitors. hence scrutinize your intended audience so that you can eradicate the difference features that are not found in your application.

This research will form the basis of your app success, and by the way, it will help you to keep making of your decisions informationally.

Finalizing the App Concept:

Developing the idea of your budget-friendly mobile payment services with the results of your market research, draft and fix. Hence determine its core features, including mobile payments, fund transfers, bill payments, loyalty programs, etc. Specify the security measures you’ll take, including encryption and two-factor authentication, to protect consumers’ financial information.

Choosing a Reliable App Development Partner:

The other critical decision here is whose app development company you will build the app for. Select The Right Mobile App Partner with a good portfolio, track record, and experience, and whose projects have all been successful in the past. Carefully choose them having the mobile wallet app development skills and ability to internalize your goals and needs. Also, the teams worth working with impact the app’s quality greatly and they affect its efficiency.

UI/UX Design:

The UI and the UX of a wallet app have to to be simple and perfectly designed for a better mobile wallet app interface. Collaborate closely with designers to develop canvases that are visually appealing and easy to use by users. Focus on user experience by creating a clean and easy-to-use interface that allows customers to perform their tasks easily. Hence conduct usability testing to refine the design and make necessary improvements.

Development:

The design phase is completed, and then the development phase starts. The development team will build the app’s front and back end. It ensures seamless integration with various payment gateways, banks, and financial institutions securely. Consider using the latest technologies like NFC, QR codes, and biometric authentication to enhance user convenience and security.

App Launch & Promotion:

Before launching the app, thoroughly test it for bugs and security vulnerabilities. Seek feedback from beta testers to iron out any remaining issues· Plan a strategic launch once the app is stable and ready for market use. Create a marketing strategy to promote the app across different channels, such as social media, app stores, and partnerships with businesses that benefit from your app’s features.

Ongoing Support:

The work doesn’t end with the app launch. Regular updates and upgrades are required to maintain the app current and secure. Hence analyze user comments and statistics to spot potential improvement areas. Regularly update the app to add new features, fix bugs, and comply with the latest security standards and regulations.

How Much Does It Cost To Develop A Mobile Wallet App?

How much does it takes of making app cost Developing mobile app is a major investment, and the costs may change according to factors like app’s complexity, features, platform compatibility and team rate.

Typically, the total cost of mobile wallet app development are in range of $50,000 to $150,000 may vary depending on these factors and the place where the development team is located, but this is the estimation.

By getting staff from a place with less labor cost, with no quality completing compromised, the cost of financial operation can be minimized.

Do not forget about the essential thing – regular maintenance and updates. It ensure the app’s longevity and security. This makes the investment worth it given the fact that the demand for digital payment solutions. It increase as well as the platform has high potential of bringing a return of investment (ROI).

Need Help To Develop A Secure Mobile Wallet App? Here’s How Bigscal Can Be Helpful

If you need a secure and reliable mobile money wallet app, consider partnering with Bigscal! With a successful track record in Mobile app development, Bigscal has the expertise and experience to turn your vision into reality.

Our team of highly qualified professionals is well-versed in putting in place state-of-the-art security measures to protect your users’ financial activities. To improve the entire user experience, we focus on developing user-friendly interfaces and seamless features.

From robust encryption to advanced authentication methods, we prioritize your app’s security while ensuring the utmost convenience for your users. Trust Bigscal as your mobile app development partner, and you’ll witness a powerful and dependable solution that fulfills all your requirements.

Conclusion

The whole process of building the hit cells application which requires a complete methodology. Why this manual happens to guide the whole development. Very clearly, it is important to systematically plan, prioritize user-centered design, and also apply robust security methods so as to create confidence and attract user-base.

While using the modern techs and integrating various fee options will definitely promote accessibility and curiosity for customers·

Conducting rigorous testing and always enhance the app is one of the critical requirements of ensuring a good user experience. Moreover, paying attention to industry trends and following the regulations are the keys to ultimate success.

Through such an approach, mobile wallet app developers may develop wealthy, safe, and user-friendly applications designed to grow successfully in the competitive fintech sphere.

FAQ

How to create a mobile wallet app?

The process of creating a mobile wallet app involves several important steps. It starts with thorough planning and research, then designing the user interface (UI) and user experience (UX). After that, the right technologies and frameworks are chosen, and the app development occurs. Rigorous testing ensures the app’s quality, and once everything is ready, the app is launched on app stores. However, continuous updates and improvements are vital to ensure the app’s long-term success.

What is a mobile wallet app?

A mobile wallet app is a digital platform enabling users to securely store, manage, and carry out diverse financial transactions, including payments, transfers, and bill payments, directly from their smartphones.

What are the key features to include in a mobile wallet app?

The critical functionalities comprise user registration and authentication, seamless payment integration (credit/debit cards, mobile wallets), comprehensive transaction history, real-time push notifications, robust security measures (data encryption, biometrics), and responsive customer support.

What is the cost of healthcare mobile app development?\

The cost of building a healthcare app can be as per the technology utilised, the app’s functionality, feature, design, and post-launch assistance. The basic price of healthcare app development can vary between $50,000 to $100,000. Furthermore, a more complex app with more features and functionalities can go up to $350,000 or more.

Which platforms should I target for my mobile wallet app?

To broaden your app’s user base, developing it for iOS and Android platforms is essential. This approach guarantees compatibility with a diverse array of smartphones and operating systems.