How does a Fintech Software Solution help the Finance Industry?

Quick Summary: Finance is an industry where innovation is unbeatable. Fintech is rapidly reshaping traditional banking methods. Today, incorporating Fintech Software Solutions into your business strategy is necessary. It secure your place in tomorrow’s financial landscape. Explore how Fintech Software Development Services can revolutionize your business.

Introduction

This is the point of time where tech advancement is changing in fact every sector. The financial industry is no exception. Hence, it drives the strong emergence of fintech software solutions. The fintech app development companies are transforming every activity indulged in the financial sector.

Fintech software development companies bring different services to the financial sector and they shape this industry through the several aspects. Through seamless financial transaction processing, and risk control, these solutions drive away financial challenges in a fast and precise manner.

Moreover, financial can software is transcending the physical limits of space. It widens financial interoperability for marginalized people to have access to internet banking apps or AI-driven investment systems. Financial technology is revolutionizing the financial environment for millions of people within their smartphones, accelerating the level of global capitalism and economic prosperity

Read this blog because we goto cover more about how Fintech Software Development Assists Finance Industry!

Overview of Fintech Software Solution

Let’s first understand what fintech solutions are.

So, these are digital tools like fintech apps. These apps aid with financial tasks and precise transactions, respectively. It is like having a handy wallet consultant that guides you through all kind of finance stuff. Furthermore, the provided services through these instruments offer solutions for handling all personal financial operations such as budgeting, retirement savings, expenses, investment, etc.

People can balance their financial endeavors with the assistance of these solutions. They can do budgeting for instance, track their spending and they know the source of the money each month. One place financial technology players that are concentrated on money matters might do is purchase and sell shares, bonds and assets at large through a brokerage firm. They make recommendations, insights, and analysis to assist in your specific goals as an investor. Some also integrate purchasing software to streamline transactions, manage subscriptions, or automate bill payments, enhancing both control and convenience.

Fintech software tools will likewise simplify processes like loan applications or life insurance management, thus making them speedier and convenient. Firstly, fintech System programs are simply digital companions. It gives you tools for the effective control of your money, especially in the current digital era.

How is Fintech Software Solution Revolutionizing the Finance Industry?

Here are how Fintech software development companies are revolutionizing by developing fintech tools:

Increased Accessibility

The fintech solutions enable financial services to be accessible to everyone. With these tools, you can manage your money or invest in funds right from your smartphone, without having to go to a bank or financial advisor. You can develop with the help of a custom software development services provider.

This solution breaks down barriers as it provides flexible interfaces cutting out the need for cumbersome documentation or in-person meetings. These tools will be helpful for even small business owners. With this tool, they can send money overseas, take loans, etc. Additionally, fintech platforms often provide quick and easy access to services that were once reserved for a privileged few.

Moreover, the fintech solutions extend beyond traditional banking services. It includes things like financial planning tools, financial apps and even small loans for entrepreneurs. By leveraging Emerging Technologies, fintech mobile app development companies are democratizing finance.

Simplified Transactions

The fintech app simplifies all financial transactions. Now people do not need to stand in long lines or deal with endless forms. All they require to do is to make simple financial transactions. These tools have transformed the way to manage finances.

These tools offer digital payment options such as mobile wallets, P2P transfers, and seamless payments. Thus, they remove the need for cash. You can just share your expenditures with your friends when you go out.

Additionally, the integration of fintech platforms with other financial tools and services, makes it easy to track debts, manage invoices and settle accounts. This automation saves time and decreases the risk of error. It ensures that transactions are accurate and transparent.

Financial Inclusion

Fintech software is available for all at any place. Suppose someone is living in a rural area and needs to open an account, but for that, they need to visit a bank that is far from your place. Fintech solutions make it easy for them to open an account from your place just by using a Fintech App. This is because fintech companies use technology to reach people in remote areas, making banking more inclusive.

Fintech software developers also fulfill different needs by creating various software. For example, they may offer low-cost accounts or flexible options, which can be very helpful if you’re new to banking or don’t have much money. In addition, fintech makes it easy to send and receive money quickly and securely, even at a distance from a bank branch.

Personalized Services

With the fintech software solutions, you can give your customers tailored services. This software learns about customer’s habits and preferences.Then, it recommends products and services on the basis of that.

Suppose, someone is saving for a big trip. Fintech apps can analyze their expenses and then suggest ways to save more without feeling like you’re missing out. These apps can help your customers to invest wisely. Instead of guessing which stocks to buy, fintech apps use algorithms to recommend investments based on goals. It’s like a personal finance plan without paying expensive fees for a human advisor.

This means you can tailor your customer financial offerings such as loans or financial advice to individual customers. It’s like giving each customer their own financial advisor who knows them inside out. With fintech software, businesses can collect and analyze data on things like spending, savings goals and risk tolerance.

Cost Reduction

The fintech software solutions robotize repetitive tasks. It removes the requirement for manual intervention, companies can significantly reduce labor costs. Additionally, fintech eliminates the need for infrastructure, such as brick and mortar branches, which in turn reduces infrastructure costs.

With the subscription-based models approaches and scalable solutions businesses can access fintech services with minimal upfront capital. This cost reduction creates capital that can be reinvested in development programs. It can also pass on customers through competitive pricing. Moreover, embracing fintech means companies can do more with less, increasing their bottom lines over the long term.

Innovation in Investment

Financial technology provides innovative methods of executing financial transactions. This makes them more obtainable and usable by businesses. Using these approaches, businesses will have more opportunity to invest both in the stock and bond markets.

In this context, companies can venture into additional kinds of investable assets apart from stocks and bonds which have been the conventional investment instruments. Example, investors can research the use of such platforms like peer-to-peer lending and automated investment. Which give lower fees and higher returns.

Now innovative software solutions by Fintech App Development Companies give businesses, among others, possibilities of cheap soaring awareness, as they can use the new ways to introduce their products and services to a huge number of potential clients. With that they can gain a bigger share of the market and maybe earn more money. It’s just like an addition to your life’s playground that will help you boost your financial achievement.

Enhanced Security

The finance sector always focuses on security. This is where fintech software solutions are stepping in and are being used to implement strong security measures that safeguard sensitive financial details. With the help of encryption, biometric authentication and multi-factor authentication. The fintech companies give the necessary safety on the user data for cyber threats.

Along with that, blockchain technology is widely used by fintech companies. This is the most secure way. It enables permanent and transparent transaction records that consequently enable security and fraud prevention. A financial business that deals in fintech software in no way results in just shielding the assets of customers. It also establish trust and integrity in the emergent digital environment.

With the use of these security measures, financial institutions will not only be able to prevent risks. It follows the applicable requirements and it also demonstrates to their clients that safeguarding their financial information is their utmost concern.

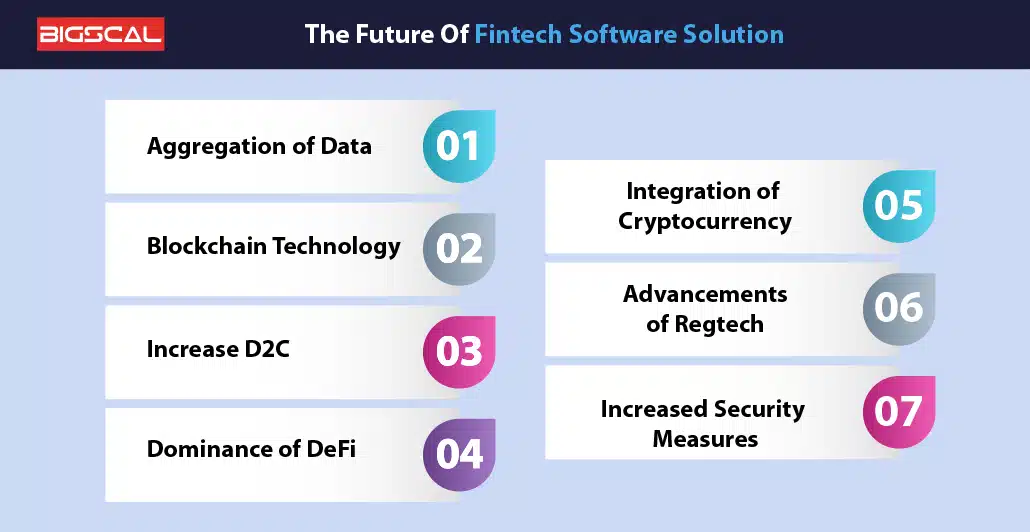

The Future Of Fintech Software Solution

Let’s have a look at the future trends of Fintech Software development:

Aggregation of Data

In the future, fintech software will demonstrate its strength in storing and untangling numerous financial data from both accounts and transactions. These data compilation will be used both to get comprehensive financial insights. With that it provides more customized suggestions. It makes the decision making process easy.

With growing algorithms and machine learning, fintech platforms will offer complex analysis and prediction. This will put their individuals and businesses in control to manage their finances successfully.

Blockchain Technology

The future is promising as blockchain technology is about to turn fintech around with safe, transparent and decentralized transactions. It would make cross-border transactions more speedy, cheaper, and easier as through smart contracts, settlements. And it will streamline other processes. Decentralized and smart contracts on the blockchain will be the result of automation of complex transactions. It will remove intermediaries that lead to less chances of error.

Furthermore, blockchain’s transparency factor will certainly build trust amongst users and improve their financial operations. This could be the key element for broadening the face and shape of financial industry.

Increase D2C

The fintech further growth would spark D2C services which will mean direct-to-consumer finance products and services which will be without intermediaries like banks. This phenomenon will arouse an individual power through the provision of financial tools and services that are customized according to them.

For D2C, people can manage their finances more independently, thus transaction speeding up and getting better; these also create a more enjoyable financial experience.

Dominance of DeFi

Decentralized Finance (DeFi) promises to take over one day as a supreme tool in fintech software development. Contrary to relying on the conventional bank systems, DeFi operates on the blockchain, hence, enabling the peer-to-peer transaction direct without any intermediaries. This model provides for cheaper fees, substantially quicker transactions.

With the DeFi progressing day by day, soon borrowing and lending, trading, and asset management will all be decentralized and will completely transform the traditional financial system.

Integration of Cryptocurrency

The integration of crypto currencies is going to be the factor that will make a fuss in the world of fintech software solutions in the long run. The emergence of digital currencies like Ethereum, Bitcoin among others. It makes financial organizations evaluate the idea of integrating cryptocurrencies to their own services.

Through this feature integration, users will be able to effortlessly control both fiat and digital currencies all on one platform. It will result in greater financial inclusivity and new investment opportunities. Cryptocurrency in fintech solutions needs enhanced security measures and fairly competent compliance processes in order to become widely adopted by financial companies.

Advancements of Regtech

The regulatory technology (Regtech) transformations will be tremendous; leveraging AI and machine learning to simplify the compliance processes. Integration of Automation monitoring systems will make look ahead at laws. Hence, it reduces the risk and operational costs faced by financial institutes. Regtech will be a facilitator for the reporting and analysis in real time, on the one hand leading to compliance with complicated regulations, on the other one promoting innovation in the finance sector.

Increased Security Measures

With cyber threat inequality on the increase, fintech organizations will focus on the much-needed security measures as way to safe guards the sensitive financial data. Biometric authentication will be increasingly used to profile individuals, recognizing them through the use of facial recognition or fingerprint scanning.

As we are living in a world where cybercrime is increasing constantly. The advancement of encryption technology and the blockchain system shall strengthen data protection. Constant monitoring and vigilant hazard prevention. Therefore, it must be the cornerstone of the relationship if fintech operations should be guaranteed to be trust and security.

Get Seamless Fintech Development Services by Bigscal technologies

If you are seeking to get help for developing a Fintech app. You must consider us.

We are one of the best custom fintech software development companies. We provide professional fintech services with 24/7 availability. If you have a great idea for a fintech application and you didn’t know how to start or how to turn your idea into a reality. That’s where we stand.

We are the fintech company that excels in designing fintech solutions that are silky smooth to use and straight to the point. Whether it is banking app, payment gateway, or budgeting tool, we will help you with it.

Our team of experts will be available for consultation, for the purpose of knowing your vision, and transforming it into a reality. From intializing and planning to development and deployment, we’ll be available throughout the entire process.

As for the development by our fintech team, trust, safety, and high-level will be guaranteed. We adopt the state-of-the-art technology and very advanced industry solutions to ensure that your application is robust and very friendly to use.

So, why to wait more? Approach us now!

Conclusion

Fintech software interface digitalize the finance industry through drastic revolution. Through the adoption of latest technologies such as artificial intelligence (AI), blockchain, and data analytics costs are reduced, security improved and customer experiences enhanced. You now have clear understanding on how Fintech software solutions are changing the way people deal with finaces. This tool will ultimately improves cultures of innovation and the future of banking.

FAQ

Who provide fintech app development services?

Fintech app development services are provided by specialists from fintech and tech companies like Bigscal technologies.

What is fintech app development company?

A Fintech app development company focuses on designing software solutions for the finance sector. Like trading firms, online banking, dealing via smartphone apps or with the help of systems that facilitate financial transactions.

What are mobile banking solutions?

Mobile banking services are the applications which can be run from mobile devices such as smart phones or tablets. It facilitating customers to be able to conduct financial activities like deposits, withdrawal or transfer of money, etc. This leads to the simplicity and accessibility of banking.

What is robotic process automation in fintech solutions?

Robotic Process Automation (RPA) which fintech solutions implement builds on the use of computer robots aimed at the automation of repetitive tasks and overall financial processes. These robots are similar to humans in interactions with digital systems and perform a work. These work includes data entry, document processing, account reconciliation, and so on. RPA empowers higher productivity, precise, and complete by reducing operations costs and current human potential liberating.

What are cutting edge technologies in Fintech app development?

Advanced technologies in fintech apps are the AI, blockchain, data analytics, machine learning (ML), biometrics and cloud computing. Which all secure and simplify the life of users and their financial services.