How Blockchain Enhancing Fintech App Development

Quick Summary: In the High tech era, just Fintech App Development won’t work. You need to implement blockchain into it. But why and how will it help? The blockchain technology revolutionizes the fintech software development process by offering improved security, transparency, and efficiency in the entity. There are more ways in which the Blockchain fintech industry!

Introduction

With deepening roots in everyday life by technology, fintech application development is changing the game face for blockchain. Seamless transparency and efficiency. Amis knows it, but blockchain technologies in the aspect of keeping data outside the cloud or any third-party entity while being able to provide immutable transaction records helps give fintech app development more cutting-edge features.

Blockchain enhances data security using cryptographic security measures, protecting sensitive financial information from cyber threats. Blockchain also provides smart contracts to automate and enter contract agreements. The use of blockchain eliminates manual intervention, reduces errors, and as a result. Moreover, fintech app developers increasingly rely on blockchain to create robust solutions. This leads to increased financial integration, reduced transaction time, and attracts more users.

Integration of blockchain in fintech applications simplifies processes by cutting out middlemen and lowers transaction costs. Smart contracts are part of blockchain technology and offer contract terms, operations, and controls for financial apps. It allows for fast and secure connections.

What Is Blockchain?

Blockchain is like a digital ledger that records transactions across computers.Consider a chain of blocks, each block containing a list of transactions. Once a block is filled, it connects to the previous one, creating a chain. What makes blockchain unique is that once a block is added, it is very difficult to change.

This is because each block contains a unique code, and changing one block would require changing all the code in the next block. Which is nearly impossible. This makes the blockchain more secure and transparent.

It is associates with cryptocurrencies like bitcoin, but its potential applications span across areas such as supply chain management, voting systems, and even healthcare records Essentially, blockchain provides trust and transparency in digital transactions as there is no need for a central authority to monitor everything.

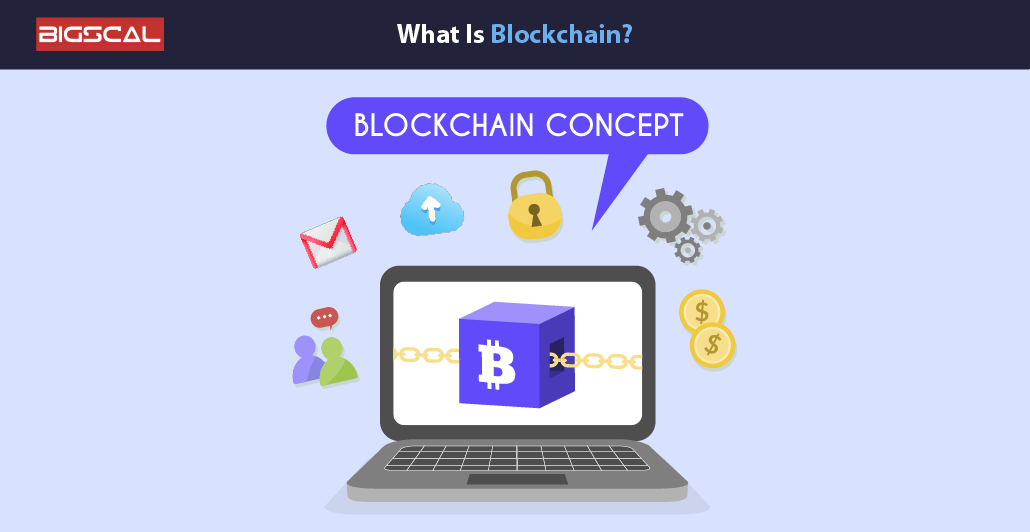

Overview Of Blockchain In FinTech Industry

Blockchain technology is transforming the FinTech industry. You can integrate it with the help of Fintech App Development Companies. Additionally, It provides secure, transparent and decentralized solutions for financial institutions. Essentially, blockchain is a ledger technology that makes transactions across multiple computers immutable and unalterable. In the FinTech sector, blockchain is for purposes, such as peer-to-peer payments, smart contracts, business finance, and identity authentication.

By eliminating intermediaries, blockchain reduces costs, speeds transactions, and increases security. Additionally, transparency builds trust between parties and provides greater financial integration and accessibility. However, challenges such as scalability, regulatory compliance and interoperability remain barriers to widespread adoption of financial technology. However, with continued development and collaboration, blockchain continues to reshape the FinTech industry. It promises a higher level of productivity and innovation in the future.

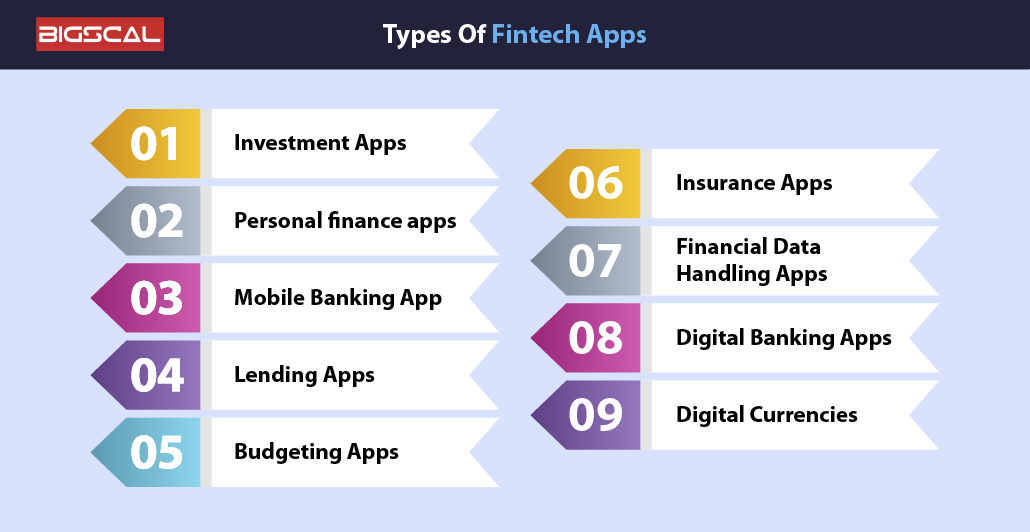

Types Of Fintech Apps

- Investment Apps

- Personal finance apps

- Mobile Banking App

- Lending Apps

- Budgeting Apps

- Insurance Apps

- Financial Data Handling Apps

- Digital Banking Apps

- Digital Currencies

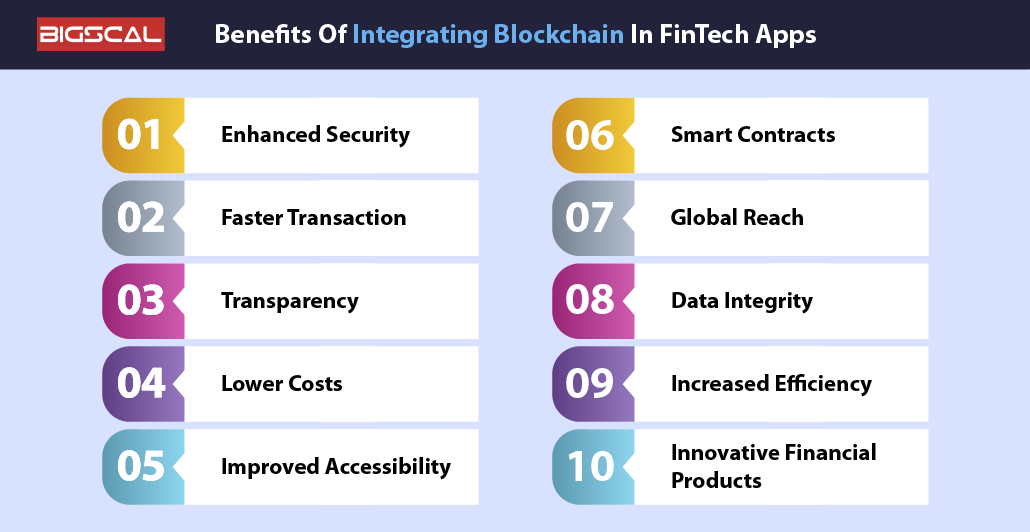

Benefits Of Integrating Blockchain In Fintech Apps Development

Here are some Benefits to financial software development services through Integrating blockchain to fintech apps.

Better Security

Blockchain technology provides better security in fintech applications through the decentralized, unalterable nature. Economic systems have the traditional way of working on a centralized database that can be easily connected and fiddled with. In blockchain, information is dispersed across a network of nodes, and it is very difficult for any nefarious human beings to sabotage the system.

Each transaction is cryptographically tied to the preceding one, thus producing an intangible report of all hobbies. Additionally, consensus mechanisms that include proof of work or proof of validation ensure that transactions are verified by way of a few parties and, as such, provide security as well.

By integrating blockchain into fintech apps, you can defend sensitive economic facts from unnecessary entry and fraudulent pastime. It will increase the belief and trust of the customers. In addition, clever contracts digital contracts saved within the blockchain enable responsive and obvious transactions without the want for intermediaries. It reduces the hazard of defects or changes

Faster Transaction

Blockchain technology allows for faster transactions in fintech apps as it eliminates middlemen and streamlines the processes. Traditional financial systems contain multiple intermediaries that include banks, clearing houses, payment processors, etc. This increases latency and costs associated with a transaction. Transactions with blockchain are peer to peer and therefore will be direct between parties. Therefore it cuts out intermediaries and reduces processing time dramatically.

The blockchain also works 24/7. Transactions may be made at any moment without discontinuity caused by bank working hours or holidays. This makes the instant repair feature highly beneficial when applied to cross-border applications because they may involve days in legacy systems before completion. Above that, it ensures full real-time transparency as to who has spent and to what extent, thereby decreasing reconciliation and settling of disputes.

Transparency

Blockchain technology integrated into Fintech App Development gives unprecedented transparency in financial transactions. Blockchain operates on a network of embedded computers called nodes. It keeps a record of every transaction in a public ledger that is distributed to the nodes of the entire network. This means all the participants in the network have access to the same information, and hence provide a clear and immutable record of all his or her work.

It allows users to see all the history of a transaction from its creation to fulfillment in real-time, thus eliminating intermediaries and consequently reducing risk in fraud or misappropriation. In addition, since the entire transaction is cryptographically sealed and time-stamped, they cannot be modified; this adds further credence and repute to the financial systems.

Costs Lower

One of the significant benefits in integrating blockchain for developing personal finance applications is that the processing cost may be less expensive. In most financial transactions, there are many middlemen who charge for their services. If these can mount fast and are meant to cross borders or entail very sophisticated financial products, the amount may shoot up exponentially.

Fintech applications can make financial transactions easier with the help of blockchain, and intermediaries together with related costs become unnecessary. In a decentralized network, due to blockchain technology, there is a possibility of straight transactions between the parties; this minimizes the unnecessary middlemen presence. The smart contracts of blockchain can also minimize costs due to the use of contracts that could erase the manual transaction and paperwork.

More importantly, fraud and security of blockchain can further reduce fraud and error, which save businesses time and money.

Increased Access

Incorporating the blockchain era in fintech programs democratizes democracy and will increase entry to monetary offerings. Blockchain fintech app answers can reach unbanked humans worldwide.

The transactions in blockchain are border less and do not need a mediator between the parties, like a bank. In blockchain-based cell apps, people can gain direct access to financial services regardless of where they stay or creditworthiness. Such accessibility increases the access to banking services for remote or excluded populations.

Also, blockchain is decentralized, making the economic information stable and non-writable, hence increasing consumers’ consideration to use such monetary services. This aspect of higher confidence increases more human beings engaging in economic activities, thus increasing the right of access to monetary services.

Smart Contracts

Smart contracts are self-executing contracts, whereby the terms of the settlement are written directly into law. Fintech applications can then easily integrate smart contracts to automate, simplify, and make the financial transaction much more transparent.

It makes the contracts mechanically where the desired standards are fulfilled, discharging the need for brokers as it decreases the transaction prices as well as the processing time. In simpler words, a smart contract allows credit disbursal, return repayment, and interest calculation and computations on an automated platform under certain pre-set benchmarks or criteria.

Furthermore, the proliferation in smart contracts guarantees transparency given that all the information pertaining to the transactions is in the blockchain; thus, there are stable and responsible corridors for economic games. Functions minimize the risks of fraudulent products and counterfeits as depicted below thus strengthening consumer and stakeholder trust.

Cross-border transactions

Integrating blockchain in the Fintech application shatters financial barriers towards inclusion and promotes transactions across borders. This aspect expands their reach across international jurisdictions. Traditional banking systems usually set various restrictions on services for remote users. Few banks are allowed because of industry and regulatory constraints. Decentralized approaches by harnessing the power of blockchain offer the solution through fintech web applications. It enables users worldwide to access financial services without looking at the traditional banking systems.

Furthermore, blockchain technology allows for peer-to-peer direct transactions, meaning that there are no middlemen by the nature of transaction, be it banks or payment processors This not only lowers the costs of transaction but also increases the speed of transaction, and makes financial transaction easier and more efficient for users irrespective of geography. A real-world example is BRICS Crypto, which enables secure, low-cost cross-border payments across BRICS nations. By using blockchain, fintech applications have the ability to reach untapped markets, and individuals living in geographies where they lack the capacity of traditional banking industries can smoothly participant in the global economy.

Data Integrity

Data integrity would be one of the primary reasons for inculcating blockchain technology in the app development process of fintech apps. A traditional financial system mostly relies on a centralized database, making the financial systems prone to data breach, manipulation, and unauthorized access. Blockchain technology utilizes a decentralized, immutable ledger wherein each transaction is cryptographically secured and linked to the previous one to create an immutable record of all transactions.

Fintech applications can ensure financial information being authentic and legitimate while utilizing blockchain’s inherent technologies of transparency, hence its confidential encryption. This ensures that high levels of confidence are gained among users while at the same time making fraud cases together with other unauthorized activities on bank accounts minimal.

Similarly, adoption of blockchain mechanisms facilitates real-time verification of transactions, therefore lessening chances of errors together with discrepancies in financial records.

Increased Efficiency

The integration of blockchain technology in fintech solutions can dramatically increase efficiency by simplifying processes and reducing the involvement of intermediaries. Blockchain will make direct transactions between parties, cutting out the need for intermediaries like banks or clearinghouses. It is faster, and it cuts down the cost of a transaction.

Apart from this, blockchain is very decentralized as well, which makes it very transparent and secure. Transactions are recorded on an intangible digital ledger that is accessible to all participants. This fraud builds confidence in the financial system because it is susceptible to fraud and error.

Moreover, the smart contracts-a facilitator of blockchain-automate and enforce agreements, reducing the role for human intervention and paperwork repeat the process This automation saves time as well as reduces the chances of error and breach or disputes with a contract.

New Products in Finance

Integrating blockchain technology in fintech applications opened avenues for creative financial products and services. Blockchain technology enabled the development of DeFi, which is an extremely wide concept of financial services devoid of the need for mediaries.

One example is the decentralized lending and borrowing platforms. There, using smart contracts, users lend or borrow digital assets directly with each other. This mechanism allows for greater financial inclusion since credit can be extended to people and businesses that the traditional banking system would otherwise not reach.

The second is the tokenization of assets, where through blockchain, assets such as real estate and company shares are made divisible and traded in small units, opening investment opportunities that were previously either not money or inaccessible for individuals as well as institutions.

Moreover, blockchain crowdfunding platforms make it possible to have decentralized funding for projects such as ICOs or STOs which have democratized opportunities for investments and significantly reduced the barriers of entry for entrepreneurs.

Use Cases Of Blockchain In Fintech mobile app development

You can apply Blockchain technology in the development of fintech mobile applications through the following methods:

1. Cryptocurrency wallets

Fintech apps can integrate blockchain so that users can safely store, send, and receive cryptocurrencies like Bitcoin, Ethereum, or stable coins.

2. Cross-border payments

Blockchain can make cross-border payments faster and cheaper by eliminating intermediaries and reducing transaction costs. Fintech apps can use blockchain to provide users with easy access to international money transfers.

3. Smart contracts

Fintech applications can make use of smart contracts, automated contracts whereby terms of the contract are written directly in law so that contracts can be negotiated and executed without any interference by intermediaries. This has facilitated options such as issuance of debt, issuance of insurance, and supplies that have aided financial management.

4. Identity verification

The type of security and privacy can be enhanced through blockchain-based identity verification solutions by providing universal digital identity to users. Through blockchain integration, fintech apps can ensure user efficiency and security in transactions such as account opening or the KYC process.

5. Asset tokenization

Blockchain allows real-world assets like real estate, stocks, or commodities to be tokenized. Fintech apps can tokenize assets, enabling fractional ownership and trading of otherwise illiquid traditional assets.

6. Immutability of transaction record

Blockchain offers an immutable book of transactions as well as an increase in transparency and accountability. Fintech applications use blockchain to enable users to see clear histories and audit trails of financial transactions.

7. Supply chain finance

On the contrary, fintech applications can leverage blockchain to optimize the finance aspect of supply chain finance. As it provides transparent and secure financial solutions. Through this service, businesses can raise more capital based on the stored supply chain data on the blockchain in the snow.

8. Decentralized Finance (DeFi)

Fintech apps can reach a growing ecosystem of decentralized financial protocols built on blockchain. It provides the following range of financial services: lending, credit, trade, seed farming without intermediaries. It provides users with flexible and efficient financial products.

Leverage Blockchain In Fintech App Development With Bigscal Technologies

Blockchain technology in fintech app development is known for its transformative power at Bigscal Technologies, increasing security, transparency, and efficiency of financial transactions with the help of blockchain.

Our team thrives on implementing blockchain solutions in various fintech applications. Smart contracts for responsive and secure transactions, DeFi for greater flexibility in financial transactions, and immutable ledgers provide transparent accounting. Blockchain Reduce associated risks of the traditional banking systems such as fraud, data manipulation, as well as transaction costs and processing time.

It unlocks the full extent of blockchain for the purpose of revolutionizing the industry about finance through technology. This can be done in a way to provide innovative solutions empowering businesses as well as users.

Conclusion

You have read through a few benefits of integrating blockchain into the Fintech app. That is why by using the blockchain, the fintech apps can make transactions even simpler, cheaper, as well as less risky to fraud. Its integration aspect is about security, transparency, and efficiency. It opens up a financial system that is inclusive and user-friendly across the globe. The more developed technology gets, the more innovation and disruption we can look forward to in the fintech industry.

FAQ

What is fintech application development?

The application of Fintech evolves software applications that rely on technology in order to produce financial services. It contains mobile banking, processing payments, investments, and even peer-to-peer lending with complicated APIs and algorithms.

How to make a fintech app?

Identify the people you are to reach out to, identify what you would like to see on your feature list and then develop an amiable interface with secure systems that work through the means of payment gateways all whilst meeting the set regulations.

What is fintech app development?

The fintech application development process typically consists of the following steps

- Conceptualization

- Market Research

- Requirements Definition

- Ui/Ux Design, Development

- Testing, Security Implementation

- Deployment, And Continued Maintenance

What are the primary categories of Fintech mobile applications?

- Mobile banking apps: They offer the conventional services of banking like account management and fund transfer.

- Payment apps: They have enabled free peer-to-peer payments, online purchases, and contactless transactions.

- Investment: It enables investors to invest in stocks or in cryptocurrencies or portfolios’ management.

- Budgeting and expenditure tracking applications: It allows the tracking of spending, setting up budgets, and then analyzing the spendings.

- Credit application: It offers loans or it enables peer-to-peer lending transactions.

- Insurance application: It covers insurance documentation, claims processing, and insurance planning.

- Personal finance management applications: It contains all-round financial planning applications such as budgeting, investing, and goal setting.

What is the cost of developing a Fintech application?

The cost to scale up a fintech app can vary significantly based fully on elements. Factors such as complexity, functions, platform (iOS, Android, net). Also, development crew place, and regulatory necessities. In contrast, a rough estimate for a basic fintech app falls in the range of $50,000 to $150,000. And complex apps may cost upwards of $250,000 or more.